For OEMs and bulk order buyers in the industrial equipment sector, the stability of component supply chains has never been more critical—or more challenging. Beneath the surface of every durable cabinet lock lies a story of global commodities markets. In 2026, this story is dominated by significant volatility and sustained price increases for key metals like copper and zinc, directly impacting manufacturing costs and procurement strategies. This analysis delves into the current market dynamics, explores their root causes, and outlines how forward-thinking partnerships with suppliers are becoming a key competitive advantage for managing customization projects and securing reliable batch order fulfillment.

1. The Market in Motion: A Snapshot of Copper and Zinc Dynamics

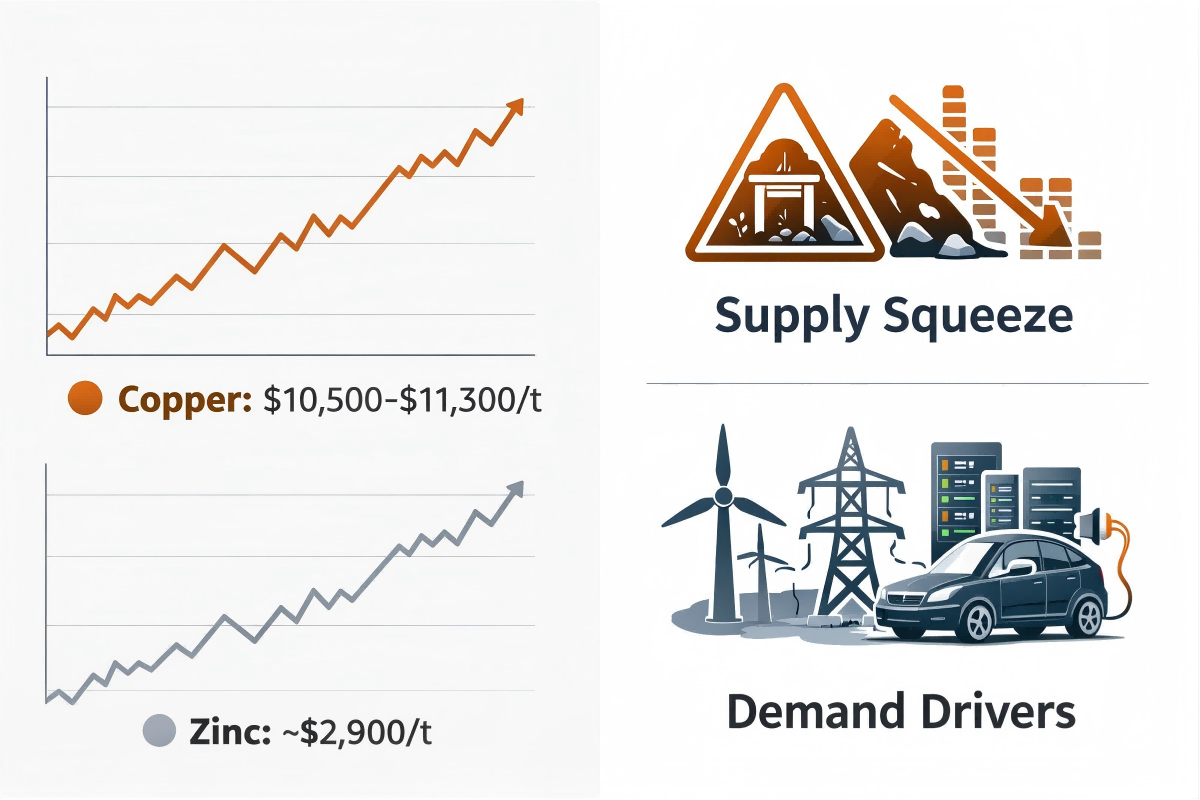

The industrial lock sector is feeling the direct impact of a metals market in flux. Recent data and institutional forecasts paint a clear picture of sustained cost pressures:

- Copper’s Structural Bull Run: Copper is experiencing a pronounced bullish phase. Major financial institutions have consistently revised their forecasts upward. As of early 2026, prices are expected to remain elevated, with analysts predicting averages between $10,500 to $11,300 per tonne for the year. Some forecasts even suggest a potential peak towards $13,500 per tonne by 2027. This isn’t short-term noise; leading sector reports describe it as a “structural” (structural bull market), driven by fundamental supply-demand imbalances.

- Zinc’s Contrasting but Relevant Trajectory: While the outlook for zinc in 2026 appears more tempered with predictions of a slight decline to around $2,900 per tonne, the market remains sensitive to broader industrial cost inflation. It’s crucial to note that localized prices, such as for specific zinc alloys in key manufacturing hubs like Dongguan, China, continue to reflect real-time market conditions, with recent prices reported around 24,980 RMB per tonne. This underscores that global forecasts and local factory gate costs can differ.

2. From Mine to Lock: Dissecting the Drivers of Cost Pressure

The price trends are not arbitrary but are driven by a powerful confluence of constraints on supply and bursts of new demand.

-

Persistent Supply-Side Squeeze:

- Mine Disruptions: Major copper mines globally, from Indonesia’s Grasberg to operations in Chile and Congo, are facing significant production challenges and disruptions.

- Long-Term Underinvestment: The industry has suffered from years of inadequate capital expenditure on new mining projects, leading to a fundamental shortage of easily accessible, high-grade ore.

- Geopolitical and Policy Factors: Events such as the indefinite closure of a major mine in Panama and new trade policies contribute to market tightness and uncertainty.

-

Unabated Demand from Megatrends:

- The Energy Transition: Global grid modernization, renewable energy projects (solar, wind), and the expansion of electric vehicle infrastructure are massively copper-intensive.

- The AI and Data Center Boom: The rapid growth of artificial intelligence and the data centers that power it is creating a substantial new source of demand for metals used in power delivery and cooling systems.

- Broad Industrial Resilience: Despite macroeconomic headwinds, demand from traditional sectors like general manufacturing and appliance production has remained steady.

This combination—tight supply meeting resilient, diversified demand—creates a classic inflationary environment for raw materials, transferring cost pressure directly to component manufacturers and their customers.

3. Strategic Sourcing in a Volatile Market: A Guide for Bulk Buyers

In this environment, a transactional approach to purchasing locks is risky. Smart procurement must evolve into strategic supply chain management. Here is a focused guide for OEMs and large-volume distributors:

-

Prioritize Supply Chain Transparency and Partnership:

- Move beyond simply comparing MOQ and unit price. Engage with suppliers who openly discuss their material sourcing strategies and hedging practices.

- A reliable manufacturer or ODM partner with strong factory controls can provide better visibility into cost structures and lead times, becoming a stable vendor rather than a source of volatility.

-

Re-evaluate the True Value of Customization:

- While customization is vital for product differentiation, it can amplify exposure to material costs.

- Work with your supplier to design for value. This might involve standardizing certain material specs across product lines or exploring design efficiencies that reduce metal use without compromising the durability required for industrial cabinet locks.

-

Focus on Total Cost of Ownership (TCO) and Quality:

- In a market where raw material costs are a dominant factor, the cheapest lock often carries the highest risk—potential corner-cutting on material purity, plating thickness, or manufacturing tolerances.

- Investing in quality-assured components from a certified factory minimizes the long-term costs of failures, returns, and maintenance in the field, protecting the value of your end equipment.

Conclusion

Building Resilient Partnerships for the Long Term:

The volatility in metals markets is a structural reality that will define the industrial components sector for the foreseeable future. For companies that rely on durable, high-performance cabinet locks, success will depend less on finding the lowest spot price and more on forging resilient, transparent partnerships with their supply chain.

At Lida Lock, we navigate these market complexities daily. As a dedicated manufacturer and collaborative ODM partner, we combine proactive material sourcing with disciplined factory management to provide our wholesale and OEM clients with stability. We offer not just products, but customized sourcing solutions and predictable scheduling for your bulk and batch order procurement, ensuring that quality and reliability are built into every lock, regardless of the market storm.

Is your supply chain prepared for ongoing market volatility?

Contact our team today for a consultation on how our stable manufacturing platform and strategic sourcing can secure your cabinet lock requirements for the year ahead.

Post time: Jan-30-2026